Exploring the realm of Sustainable Life Coverage with Long-Term Benefits unveils a world where financial security meets environmental consciousness. This topic delves into the importance of sustainable life coverage, the concept of long-term benefits in insurance, and the advantages it offers over traditional plans.

Get ready to discover how this innovative approach can benefit individuals and families in the long run.

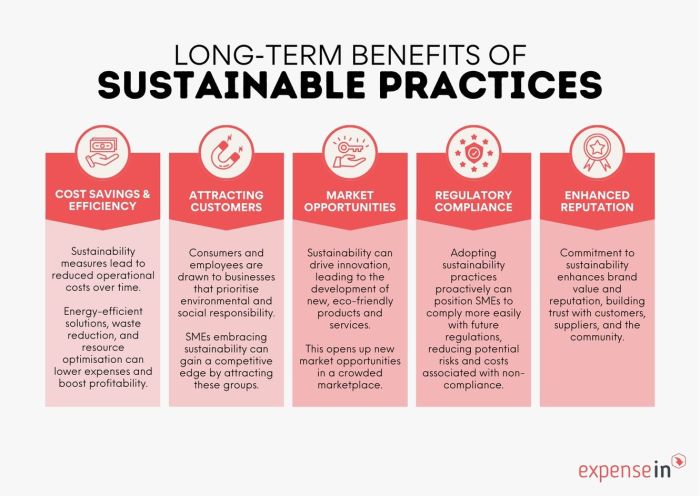

Introduction to Sustainable Life Coverage with Long-Term Benefits

Sustainable life coverage refers to insurance policies that not only provide financial protection in the present but also ensure long-term benefits for individuals and their families. In the realm of insurance, long-term benefits encompass the idea of securing a stable financial future through strategic planning and investments.

Opting for sustainable life coverage over traditional insurance plans offers numerous advantages, such as greater flexibility, increased savings potential, and extended coverage duration.

Advantages of Sustainable Life Coverage

- Flexible Premiums: Sustainable life coverage often allows policyholders to adjust their premium payments according to their financial situation, providing a level of adaptability not typically found in traditional insurance plans.

- Investment Opportunities: Many sustainable life coverage policies offer the option to grow cash value over time through various investment vehicles, providing an additional avenue for wealth accumulation.

- Extended Coverage: Unlike some traditional insurance plans that may expire after a certain period, sustainable life coverage can offer lifelong protection, ensuring that beneficiaries receive financial support even in the long run.

Examples of Long-Term Benefits

For instance, a young individual who invests in sustainable life coverage early on can benefit from compounded growth over the years, leading to a substantial financial nest egg for retirement. Similarly, families that prioritize sustainable life coverage can secure a stable financial foundation that can support future generations and provide peace of mind in times of need.

Key Features of Sustainable Life Coverage

Sustainable life coverage offers a unique set of features that set it apart from traditional insurance products. Not only does it provide financial protection for policyholders and their loved ones, but it also aligns with environmental and social sustainability goals, making it a choice for individuals who want to make a positive impact on the world while securing their future.

Customizable Coverage Options

When it comes to sustainable life coverage, policyholders have the flexibility to customize their coverage to meet their long-term financial and life goals. This means they can choose the coverage amount, premium payment schedule, and additional benefits that best suit their needs.

By tailoring their policy, individuals can ensure that they are adequately protected while also staying aligned with their values and objectives.

Socially Responsible Investments

Another key feature of sustainable life coverage is the option to invest in socially responsible funds. Policyholders can choose to allocate a portion of their premiums towards investments that support environmental conservation, social justice, and sustainable development. This not only allows individuals to grow their wealth over time but also contribute to meaningful causes that are important to them.

Transparent and Ethical Practices

Sustainable life coverage providers often operate with a commitment to transparency and ethical practices. This means that policyholders can trust that their premiums are being managed responsibly and in line with sustainable principles. By choosing a provider with a strong ethical foundation, individuals can have peace of mind knowing that their coverage is not only financially secure but also ethically sound.

Investment Components in Sustainable Life Coverage

When it comes to sustainable life coverage, the investment component plays a crucial role in providing long-term benefits. These plans offer a range of investment options that not only aim to secure financial stability but also contribute to sustainable and socially responsible initiatives.

Types of Investment Options

Within sustainable life coverage plans, policyholders can choose from a variety of investment options such as:

- Equity Funds: These funds invest in socially responsible companies that adhere to environmental and ethical standards.

- Green Bonds: These bonds are issued to fund environmentally friendly projects, providing a stable return while supporting sustainability.

- Impact Investments: This option focuses on generating positive social and environmental impact alongside financial returns.

Potential Returns Comparison

Investing through sustainable life coverage plans offers the potential for competitive returns when compared to traditional investment vehicles. Studies have shown that sustainable investments have the potential to outperform conventional investments in the long run, as companies with strong sustainability practices tend to be more resilient and profitable.

Impact on Environment and Society

Sustainable investments made through life coverage plans have a positive impact on the environment and society. By directing funds towards sustainable initiatives, policyholders contribute to the development of clean energy, social welfare programs, and environmental conservation efforts. This not only aligns with ethical values but also fosters a more sustainable future for generations to come.

Risk Management and Contingency Planning in Sustainable Life Coverage

Sustainable life coverage not only offers long-term benefits but also plays a crucial role in addressing risk management and contingency planning for policyholders. By understanding and preparing for unforeseen circumstances, individuals and families can mitigate financial risks and secure their future.

Risk Mitigation through Sustainable Life Coverage

- Sustainable life coverage provides financial protection in case of unexpected events such as illness, disability, or death. Policyholders can rest assured that their loved ones will be taken care of in such situations.

- Insurance companies offer various riders and add-ons to customize policies based on individual needs, allowing policyholders to enhance their coverage and address specific risks.

- Through proper risk assessment and financial planning, sustainable life coverage helps individuals create a safety net for themselves and their families, ensuring stability and security in the long run.

Role of Insurance Companies in Contingency Planning

- Insurance companies play a crucial role in supporting policyholders during unforeseen circumstances by providing financial assistance and guidance when needed.

- They offer claim settlement services promptly and efficiently, helping policyholders navigate challenging situations with ease and confidence.

- Insurance companies also provide expert advice on risk management strategies, helping policyholders make informed decisions to protect their financial well-being.

Closing Summary

In conclusion, Sustainable Life Coverage with Long-Term Benefits emerges as a promising avenue for securing financial stability while contributing to a sustainable future. By customizing coverage to align with long-term goals and investing in environmentally conscious options, individuals can safeguard their future while making a positive impact.

FAQ Resource

How does sustainable life coverage differ from traditional insurance?

Sustainable life coverage focuses on long-term benefits, aligning with environmental and social sustainability goals, while traditional insurance plans may not have these considerations.

Can policyholders customize their coverage with sustainable life plans?

Yes, policyholders can tailor their sustainable life coverage to meet their specific financial and life goals, offering flexibility and personalized options.

What are the investment options available within sustainable life coverage?

Sustainable life coverage plans typically offer investment choices that support sustainable initiatives, potentially yielding returns that align with environmental and social impact goals.

How does sustainable life coverage address risk management for policyholders?

Sustainable life coverage helps individuals and families mitigate financial risks in the long term, providing a safety net for unforeseen circumstances.