Embark on a journey into the realm of holistic lifestyle plans with financial coverage. Discover how these integrated approaches can revolutionize your well-being and financial security in unexpected ways.

Delve into the essential components and strategies for designing effective holistic lifestyle plans with financial coverage. Uncover common challenges and their solutions to optimize your path towards a balanced and secure lifestyle.

Importance of Holistic Lifestyle Plans

Living a holistic lifestyle involves taking care of all aspects of your well-being, including physical, mental, emotional, and spiritual health. Holistic lifestyle plans emphasize the interconnectedness of these areas and aim to create balance and harmony in one's life.

Benefits of Integrating Financial Coverage into Holistic Lifestyle Plans

Financial coverage plays a crucial role in supporting overall well-being in holistic lifestyle plans. Here are some examples of how financial coverage can contribute to a holistic approach to health:

- Peace of Mind: Having financial coverage for unexpected medical expenses or emergencies can reduce stress and anxiety, allowing individuals to focus on their overall well-being.

- Access to Healthcare: With financial coverage, individuals can access necessary healthcare services, preventive screenings, and treatments to support their physical health.

- Investing in Self-Care: Financial coverage can enable individuals to invest in self-care practices such as therapy, wellness retreats, or fitness classes, enhancing their mental and emotional well-being.

- Planning for the Future: Financial coverage can help individuals plan for their future financial stability, retirement, and long-term care needs, ensuring holistic well-being across the lifespan.

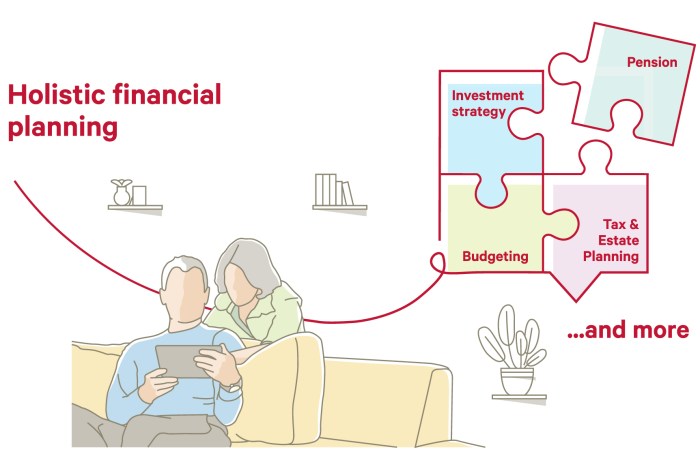

Components of Holistic Lifestyle Plans with Financial Coverage

When creating a holistic lifestyle plan with financial coverage, it is essential to consider various key components that will contribute to overall well-being and financial security.

Key Components of a Holistic Lifestyle Plan:

- Physical Health: Incorporating exercise routines, healthy eating habits, and regular check-ups to maintain physical well-being.

- Mental Health: Including stress management techniques, mindfulness practices, and therapy sessions to support mental wellness.

- Emotional Health: Fostering healthy relationships, practicing self-care, and engaging in activities that bring joy and fulfillment.

- Social Health: Building a supportive community, nurturing friendships, and participating in group activities for social connections.

- Financial Security: Setting financial goals, creating a budget, saving for emergencies, and investing for the future to ensure financial stability.

Financial Coverage Options in Holistic Lifestyle Plans:

There are specific financial coverage options that can be integrated into holistic lifestyle plans to provide additional support and security:

- Health Insurance: Covering medical expenses for illnesses, injuries, and preventive care.

- Life Insurance: Providing financial protection for loved ones in the event of the policyholder's death.

- Disability Insurance: Offering income replacement if the policyholder becomes unable to work due to a disability.

- Critical Illness Insurance: Paying a lump sum benefit upon diagnosis of a severe illness covered by the policy.

- Long-Term Care Insurance: Assisting with the costs of long-term care services, such as nursing home care or home health care.

Approaches to Integrating Financial Coverage within Holistic Lifestyle Plans:

There are different approaches to incorporating financial coverage into holistic lifestyle plans, each with its own benefits and considerations:

Some individuals may choose to purchase separate insurance policies for health, life, disability, and critical illness coverage to address specific needs comprehensively.

Others may opt for a comprehensive insurance plan that combines different types of coverage into a single policy for convenience and potentially cost savings.

Alternatively, some holistic lifestyle plans may include a combination of insurance coverage, savings accounts, and investment portfolios to create a diversified financial strategy.

Strategies for Designing Effective Holistic Lifestyle Plans with Financial Coverage

Creating a holistic lifestyle plan that includes financial coverage requires careful planning and consideration. By integrating financial goals with overall well-being, individuals can ensure a balanced and sustainable approach to their health and wealth.

Personalized Planning Tips

- Assess your current financial situation and health goals to determine your needs.

- Consult with a financial advisor and healthcare professional to create a tailored plan.

- Set specific and achievable objectives that align with both your health and financial aspirations.

- Regularly review and adjust your plan based on changes in your circumstances or priorities.

Setting Realistic Goals and Milestones

- Break down your holistic lifestyle plan into smaller, manageable steps to track progress effectively.

- Establish clear timelines and deadlines for each goal to stay motivated and accountable.

- Include financial milestones alongside health targets to ensure a comprehensive approach to well-being.

Successful Implementation Strategies

- Automate savings and investments to maintain financial stability while pursuing health-related activities.

- Utilize technology and apps to track your expenses, exercise routines, and nutrition intake for better monitoring.

- Join support groups or wellness communities to stay motivated and engaged in your holistic lifestyle journey.

Challenges and Solutions in Implementing Holistic Lifestyle Plans with Financial Coverage

Implementing holistic lifestyle plans with financial coverage can present various challenges for individuals seeking to prioritize their well-being while managing their finances effectively. It is crucial to address these challenges proactively to ensure the successful integration of financial coverage into holistic lifestyle plans.

Let's explore some common challenges and propose solutions to overcome these barriers, emphasizing the importance of adaptability and flexibility in the process.

Identifying the Right Financial Coverage

One of the primary challenges individuals face is selecting the appropriate financial coverage that aligns with their holistic lifestyle goals. With a plethora of insurance options available, it can be overwhelming to determine which ones offer the best protection for both health and finances.

- Research different insurance policies and compare their benefits to find one that suits your needs.

- Consult with a financial advisor to receive personalized recommendations based on your holistic lifestyle objectives.

- Regularly review and update your coverage to ensure it remains relevant to your changing circumstances.

Balancing Costs and Benefits

Another common challenge is striking a balance between the costs of financial coverage and the benefits it provides. Some individuals may struggle to afford comprehensive insurance plans while others may be tempted to opt for cheaper options that offer limited coverage.

- Evaluate the long-term advantages of investing in quality financial coverage, considering potential savings on medical expenses in the future.

- Look for discounts or incentives offered by insurance providers to make premium payments more manageable.

- Seek alternative financing options such as health savings accounts or flexible spending arrangements to supplement your insurance coverage.

Adapting to Lifestyle Changes

Maintaining a holistic lifestyle involves embracing changes in various aspects of life, including health, relationships, and finances. Adapting to these changes can be challenging, especially when they impact your financial coverage and require adjustments to your existing plans.

- Stay informed about updates in insurance regulations and coverage options to make informed decisions when modifying your financial plan.

- Regularly reassess your holistic lifestyle goals and adjust your financial coverage accordingly to ensure alignment with your evolving priorities.

- Seek professional guidance from holistic lifestyle coaches or financial experts to navigate transitions effectively and optimize your overall well-being.

Final Thoughts

In conclusion, embracing holistic lifestyle plans with financial coverage paves the way for a harmonious existence where your health and wealth intersect. Let these insights guide you towards a future filled with vitality and stability.

Expert Answers

How do holistic lifestyle plans differ from traditional lifestyle plans?

Holistic lifestyle plans focus on integrating physical, mental, and emotional well-being, while traditional plans may only address one aspect.

What are some common financial coverage options that can be included in holistic lifestyle plans?

Examples include health insurance, life insurance, disability insurance, and investment portfolios.

How can one set realistic goals within a holistic lifestyle plan with financial coverage?

Start by assessing your current situation, identify areas for improvement, and set achievable milestones in both health and financial aspects.

What challenges might individuals face when implementing holistic lifestyle plans with financial coverage?

Challenges may include financial constraints, lack of knowledge about available options, and difficulty in balancing immediate needs with long-term goals.

Why is adaptability crucial in maintaining holistic lifestyle plans with financial coverage?

Adaptability allows individuals to adjust their plans according to changing circumstances and priorities, ensuring sustained progress towards holistic well-being.