The Simplified Life Insurance Application Process Explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the intricacies of this process, we uncover the key steps, importance of user-friendly interfaces, and the significance of personalization and customization in life insurance applications.

Overview of Simplified Life Insurance Application Process

A simplified life insurance application process refers to a streamlined and efficient method of applying for life insurance coverage. This process typically involves minimal paperwork, shorter application forms, and quicker approval times compared to traditional methods.

The benefits of a simplified life insurance application process in the insurance industry are numerous. Firstly, it reduces the burden on applicants by making the application process more straightforward and less time-consuming. This, in turn, can lead to higher customer satisfaction and increased likelihood of individuals obtaining the life insurance coverage they need.

Companies with Successful Implementation

- 1. Lemonade: Lemonade is a digital insurance company that has revolutionized the insurance industry with its simplified application process. They offer life insurance policies that can be applied for and approved within minutes, thanks to their use of artificial intelligence and technology.

- 2. Ethos: Ethos is another example of a company that has successfully implemented a simplified life insurance application process. They offer term life insurance policies that can be applied for online in a matter of minutes, without the need for medical exams or lengthy paperwork.

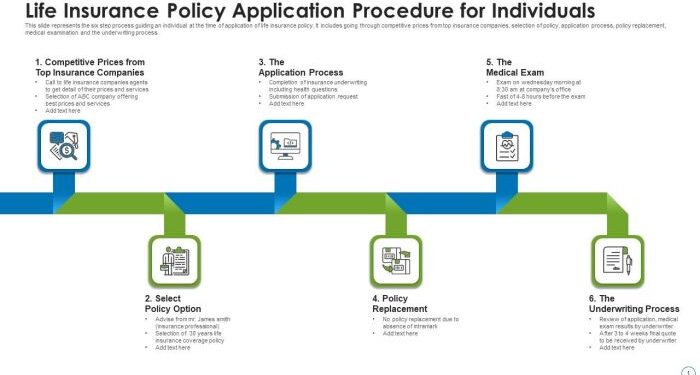

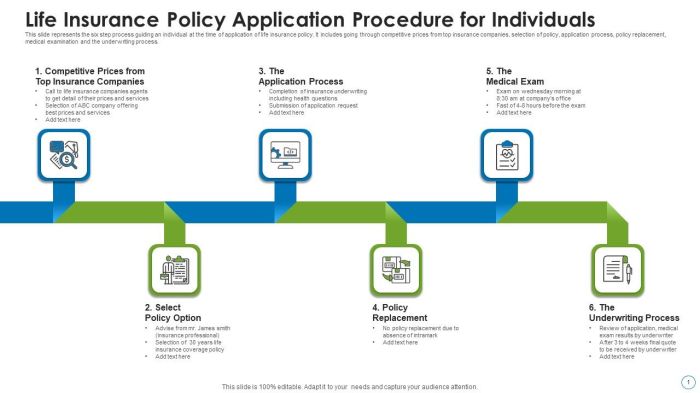

Key Steps in a Simplified Life Insurance Application Process

Life insurance application processes have become more streamlined and accessible in recent years, thanks to advancements in technology. Here are the key steps involved in a simplified life insurance application process:

1. Online Application Submission

One of the first steps in a simplified life insurance application process is the submission of an online application. This eliminates the need for lengthy paperwork and allows applicants to provide necessary information digitally.

2. Automated Underwriting

Technology has enabled the use of automated underwriting systems that can quickly assess an applicant's risk profile based on the information provided. This helps expedite the approval process and reduces the need for manual review.

3. Electronic Signatures

Electronic signatures have made it easier for applicants to sign documents remotely, eliminating the need for in-person meetings or physical paperwork exchange. This enhances convenience and accelerates the overall application process.

4. Data Analytics for Risk Assessment

Data analytics play a crucial role in streamlining the life insurance application process by analyzing vast amounts of data to assess an applicant's risk profile accurately. Insurers can leverage this information to make informed underwriting decisions quickly.

Importance of User-Friendly Interfaces in the Application Process

Having user-friendly interfaces in the life insurance application process is crucial for ensuring a smooth and efficient experience for applicants. These interfaces play a significant role in simplifying the complex application process, making it easier for users to understand and navigate through the necessary steps.

Designing Intuitive Interfaces for Insurance Applications

When designing interfaces for insurance applications, it is essential to follow best practices to ensure a user-friendly experience. Some key best practices include:

- Clear and concise layout: Ensure that the interface is clean, organized, and easy to navigate, with clear labels and instructions.

- Minimize form fields: Reduce the number of required fields to streamline the application process and prevent user frustration.

- Progress indicators: Implement progress bars or indicators to show users where they are in the application process and how much more is left to complete.

- Interactive elements: Include interactive elements such as dropdown menus, checkboxes, and radio buttons to make data entry more user-friendly.

- Mobile responsiveness: Design interfaces that are mobile-responsive to cater to users accessing the application process on various devices.

Role of Mobile Applications in Enhancing User Experience

Mobile applications play a crucial role in enhancing the user experience during the life insurance application process. Some benefits of mobile applications include:

- Convenience: Mobile applications allow users to complete the application process anytime, anywhere, providing convenience and flexibility.

- Instant access: Users can easily access their application progress, documents, and information on-the-go through mobile apps.

- Push notifications: Mobile apps can send push notifications to remind users of pending tasks, deadlines, or required actions, keeping them informed throughout the process.

- Enhanced security: Implementing secure login features and encryption in mobile applications ensures the safety of user data and sensitive information.

Personalization and Customization in Simplified Life Insurance Applications

Personalization and customization play a crucial role in simplifying the life insurance application process and meeting individual needs. By tailoring the application experience to each customer, insurers can enhance user satisfaction and increase engagement. Let's explore how personalization can be integrated into the application process to provide a more customized experience.

Integration of Personalization

- Insurers can personalize the application by offering tailored policy recommendations based on the customer's specific needs and preferences. This can include suggesting coverage amounts, policy types, and riders that align with the individual's financial goals and lifestyle.

- Customizing the application journey by allowing users to choose their preferred communication channels, such as email, phone, or in-person meetings, can enhance the overall experience and make the process more convenient for the applicant.

Examples of Customization

- Providing different premium payment options, such as monthly, quarterly, or annual payments, to accommodate varying budget preferences.

- Offering a range of policy customization options, such as adding riders for critical illness coverage, disability benefits, or accidental death benefits, based on the customer's unique needs.

Challenges and Benefits

- Challenges: Implementing personalized options in life insurance applications can present challenges in terms of data security and privacy concerns. Insurers must ensure that customer data is protected and used ethically to avoid any breaches or misuse.

- Benefits: Personalization can lead to higher customer satisfaction, increased policy sales, and improved customer retention rates. By offering tailored solutions, insurers can build stronger relationships with customers and enhance brand loyalty.

Final Conclusion

In conclusion, the Simplified Life Insurance Application Process Explained opens doors to a more efficient and tailored insurance experience, paving the way for a future where obtaining life insurance is simpler and more personalized than ever before.

FAQ Compilation

What is a simplified life insurance application process?

A simplified life insurance application process involves streamlining the steps required to apply for life insurance, making it quicker and more user-friendly.

How has technology transformed the application process?

Technology has revolutionized the application process by introducing digital platforms that automate tasks, reduce paperwork, and enhance overall efficiency.

Why is personalization important in life insurance applications?

Personalization allows insurers to tailor the application experience to individual needs, increasing customer satisfaction and engagement.