"Exploring the nuances of business insurance, specifically delving into the comparison between general and professional liability coverage, opens up a world of essential knowledge for entrepreneurs and business owners alike."

"This guide aims to shed light on the key differences, considerations, and customization options to help you make informed decisions when it comes to protecting your business."

Understanding Business Liability Coverage

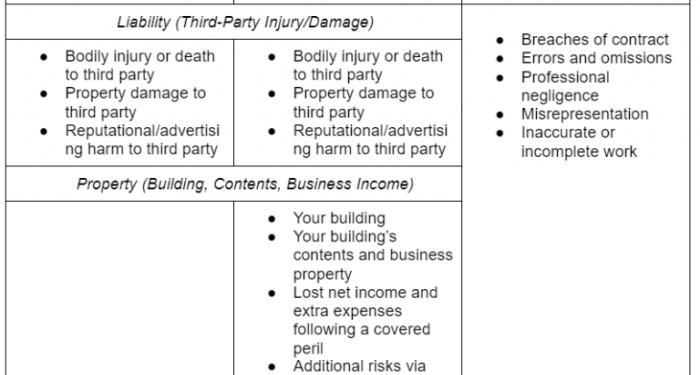

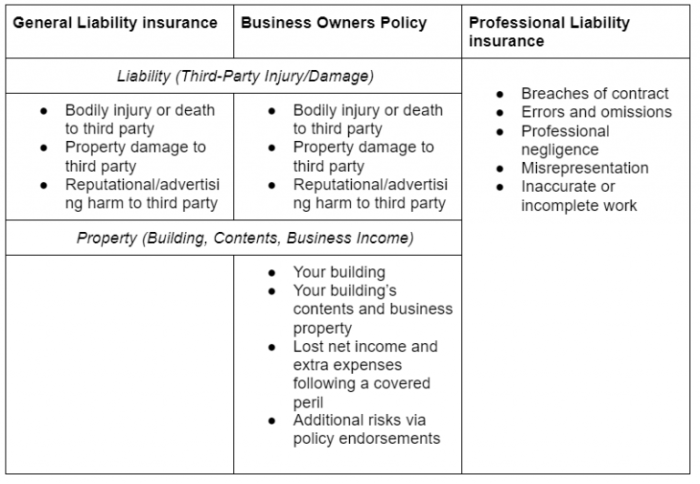

Business liability coverage is essential for protecting your business from potential financial risks associated with lawsuits and claims. There are two main types of business liability coverage: general liability and professional liability.

General Liability Coverage

General liability coverage provides protection for a wide range of common risks that businesses face. This type of coverage typically includes protection against bodily injury, property damage, and advertising injury claims.

- Example: A customer slips and falls in your store, resulting in injuries. General liability coverage would help cover the medical expenses and legal fees associated with the claim.

- Example: Your advertisement unintentionally uses a copyrighted image, leading to a copyright infringement claim. General liability coverage would help cover the costs of resolving the claim.

Professional Liability Coverage

Professional liability coverage, also known as errors and omissions insurance, is specifically designed to protect businesses that provide professional services. This type of coverage helps protect against claims of negligence, errors, or omissions in the services provided.

- Example: A client claims that your accounting firm made a mistake in their tax filings, resulting in financial losses. Professional liability coverage would help cover the costs of defending against the claim and any damages awarded.

- Example: A consultant provides advice to a client that leads to a financial loss. Professional liability coverage would help cover the costs associated with the claim for professional negligence.

Factors to Consider When Comparing Coverage

When comparing business liability coverage, there are several key factors to consider that can greatly impact the protection and financial security of your business.

Coverage Limits and Deductibles

- It is crucial to carefully review the coverage limits and deductibles offered by different insurance providers. Coverage limits determine the maximum amount the insurance company will pay out for a claim, while deductibles are the out-of-pocket expenses you must cover before the insurance kicks in.

- Choosing appropriate coverage limits and deductibles that align with your business's risk exposure and financial capabilities is essential to ensure adequate protection without breaking the bank.

Industry Type Impact

- The nature of your business plays a significant role in determining whether you need general liability, professional liability, or both types of coverage. Some industries may have higher risks of lawsuits or claims, making professional liability coverage more crucial, while others may benefit more from general liability protection.

- Understanding the specific risks associated with your industry will help you make an informed decision on the type of coverage that best suits your business needs.

Business Size and Coverage

- The size of your business also influences the type and amount of coverage you require. Larger businesses with more assets and employees may need higher coverage limits to adequately protect against potential risks and liabilities.

- Smaller businesses, on the other hand, may opt for more basic coverage to manage costs while still maintaining essential protection.

Evaluating Insurance Providers

- When comparing insurance providers, it is essential to assess their reputation and financial stability. A reliable insurance company with a strong track record of customer satisfaction and prompt claim settlements can provide you with peace of mind knowing that your business is in good hands.

- Research customer reviews, ratings, and financial strength ratings from independent agencies to gauge the reliability and credibility of insurance providers before making a decision.

Coverage Customization Options

When it comes to business liability coverage, customization options play a crucial role in ensuring that a company is adequately protected against potential risks. Let's explore the various ways in which general liability and professional liability coverage can be tailored to meet specific business needs.

Optional Coverage Add-Ons for General Liability Insurance

General liability insurance typically covers bodily injury, property damage, and advertising injury claims. However, businesses may choose to enhance their coverage by adding optional endorsements such as:

- Product Liability Coverage: Protects against claims related to products sold or manufactured by the business.

- Hired and Non-Owned Auto Liability: Extends coverage to vehicles not owned by the business but used for company operations.

- Cyber Liability Insurance: Covers expenses related to data breaches and cyberattacks.

Common Endorsements Available for Professional Liability Coverage

Professional liability insurance, also known as errors and omissions insurance, safeguards businesses against claims of negligence or inadequate work performance. Some common endorsements include:

- Extended Reporting Period Endorsement: Allows coverage for claims made after the policy has expired.

- Defense Cost Outside the Limits: Covers legal defense costs in addition to the policy limit.

- Technology Errors and Omissions: Provides coverage for technology-related services or advice.

Tailoring Coverage to Specific Business Needs

Customization options in liability coverage allow businesses to tailor their policies to address unique risks and exposures. For example:

- A consulting firm may require coverage for professional advice and services, making professional liability customization essential.

- A retail store selling products may benefit from product liability coverage as an add-on to their general liability policy.

Scenarios Requiring Customization

Customization of liability coverage may be necessary in scenarios such as:

- A contractor taking on a new project that requires additional coverage for subcontractors involved in the work.

- A technology company facing increasing cyber threats and in need of specialized cyber liability protection.

Cost Analysis and Budgeting

When it comes to analyzing the costs and budgeting for business liability coverage, there are several key factors to consider. Understanding how premiums are calculated, effective budgeting strategies, and the cost-effectiveness of bundled versus separate policies can help you make informed decisions about your insurance needs.

How Premiums are Calculated

- Insurance companies consider various factors when calculating premiums for general and professional liability coverage. These factors may include the size and type of your business, the industry you operate in, past claims history, coverage limits, and deductible amounts.

- Premiums are typically higher for businesses in high-risk industries or those with a history of frequent claims. Conversely, businesses with a strong track record of safety and low claims may qualify for lower premiums.

- Professional liability premiums may be based on the specific services your business offers, the level of risk associated with those services, and the coverage limits you choose.

Strategies for Budgeting Insurance Costs

- Review your current insurance coverage and assess your business's risk exposure to determine the appropriate level of coverage needed.

- Consider bundling your general and professional liability coverage with a single insurer to potentially save money on premiums.

- Set aside a dedicated budget for insurance costs and regularly review and adjust it as needed based on changes in your business operations or risk profile.

Comparing Bundled Coverage vs. Separate Policies

- While bundling your general and professional liability coverage with the same insurer can result in cost savings, it's essential to compare the total cost of bundled coverage with separate policies to ensure you're getting the best value for your money.

- Separate policies may offer more flexibility in terms of coverage limits and customization options, but they could potentially be more expensive than bundled coverage.

Negotiating Premiums with Insurance Providers

- Before renewing or purchasing a new insurance policy, consider negotiating with your insurance provider for lower premiums. Highlight your business's positive claims history, safety measures, and risk management practices to potentially qualify for discounts.

- Obtain quotes from multiple insurers and compare them to leverage competitive pricing and negotiate better rates.

Last Word

"In conclusion, understanding the intricacies of business general and professional liability coverage is crucial for safeguarding your enterprise against potential risks. By carefully evaluating your needs and exploring customization options, you can ensure comprehensive protection for your business ventures."

FAQ Insights

"What is the significance of coverage limits and deductibles?"

"Coverage limits determine the maximum amount an insurer will pay for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in."

"How does industry type impact the choice between general and professional liability coverage?"

"Certain industries may face unique risks that are better covered by professional liability insurance, while others might benefit more from general liability coverage. It's essential to assess your industry's specific needs."

"What are common endorsements available for professional liability coverage?"

"Common endorsements include coverage for legal defense costs, cyber liability, and errors and omissions. These endorsements can enhance your policy to suit your business requirements."

"How can one effectively negotiate premiums with insurance providers?"

"Researching multiple providers, maintaining a good claims history, bundling policies, and demonstrating a commitment to risk management can all help in negotiating lower premiums."